Course Content

Course Content

About Course

FRM Lessons

Course Content

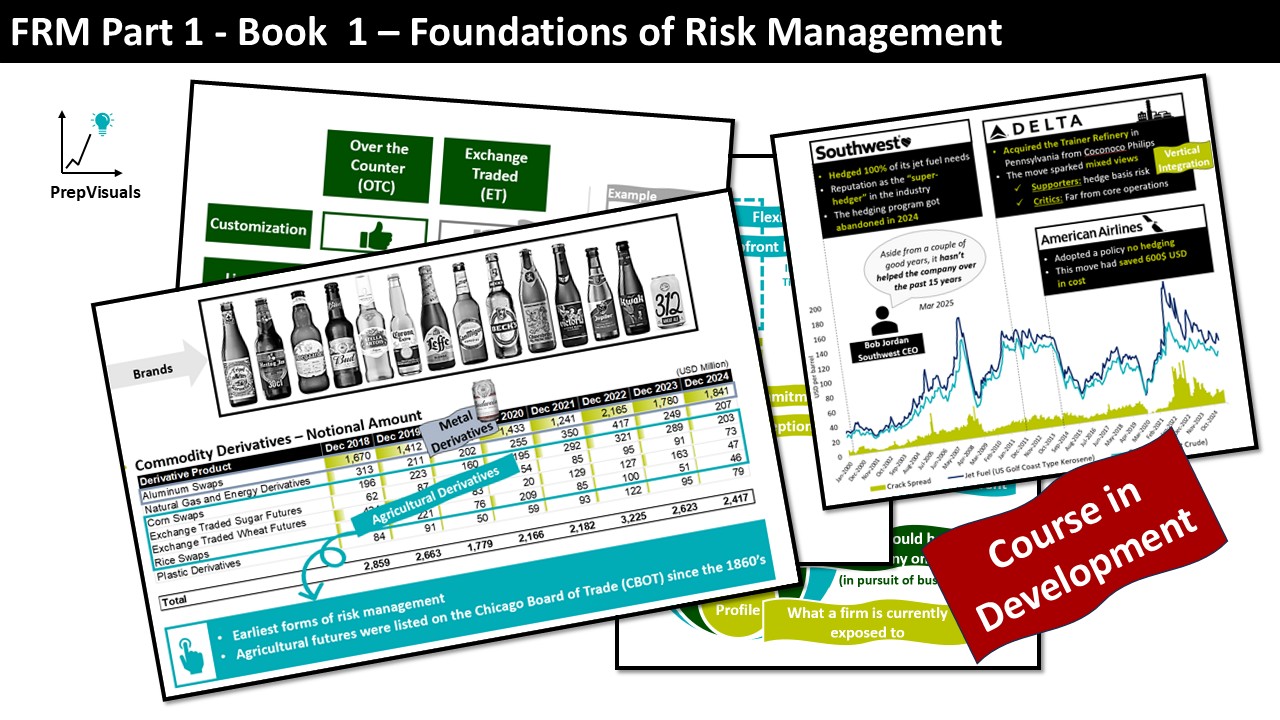

Chapter 1 – The Building Blocks of Risk Management

-

1. Risk Management Historical Timeline

11:17 -

2. Building Blocks of Risk Management & Typologies of Risk

05:05 -

3. Typologies of Risk

09:11 -

4. The Risk Management Process

08:01 -

5. Identifying Risk – Knowns and Unknowns

06:41 -

6. Expected Loss, Unexpected Loss & Tail Loss

05:56 -

7. Risk Factor Breakdown

03:12 -

8. Structural Change – From Tail Risk to Systemic Risk

03:32 -

9. Human Agency and Conflict of Interest

04:04 -

10. Risk Aggregation

05:52 -

11. Balancing Reward & Risk

03:30 -

12. Enterprise Risk Management (ERM)

03:14

1. Risk Management Historical Timeline

Student Ratings & Reviews

No Review Yet